BookTrib’s Bites: Poetry, Life Lessons for Kids and Adolescents

“The Absolute: Collected Poems of Sri Chinmoy”

“The Absolute: Collected Poems of Sri Chinmoy”

This book is a collection of Sri Chinmoy’s poems, selected from his entire body of poetic work that spans more than six decades. All of his early poems were written from within the poetic restraints of meter and rhyme. Only later in his poetic career did he write in free verse.

Speaking of his poetry, Sri Chinmoy says, “Throughout my poetry-journey, my poetry-tree has cherished various branches: philosophy, prayer, religion, spirituality, my love of Nature’s beauty, my love of word-making, which the English language indulgently allows me to explore, and my abiding love, concern and hope for this world of ours.” Sri Chinmoy’s poetry offers hope, strength and salvation to many an earnest traveler in his or her journey through life.

Purchase at https://bit.ly/3OiiMPe.

“Mark Victor Hansen, Relentless”

“Mark Victor Hansen, Relentless”

by Mitzi Perdue

Winner of the Literary Titan Award for Nonfiction. “The Chicken Man’s” wife writes about the “Chicken Soup” guy. Mitzi Perdue spoke to many of the important people who inspired “Chicken Soup for the Soul,” co-author Mark Victor Hansen along the way and to those with whom he made a true difference in their lives. Hansen conquered many mountains by never letting any obstacle get in his way and by inspiring others to make a difference. His story is exceptional, but it is his extraordinary perseverance and generosity that led to his long-term success.

Perdue is a meticulous writer who captures the essence of Mark with true stories that are inspiring and amazing in showing the tenacity of one man who learned that in order to receive, first you must give.

Purchase at https://amzn.to/3udF0dY.

“TARRA: Mission to Earth”

“TARRA: Mission to Earth”

by Inna Van Der Velden

Anthony and his friends come to Earth to find the antidote for the fear dust pollution. The children on their native planet, Tarra, are in severe danger. If Anthony’s mission doesn’t succeed, life on Tarra will cease to exist.

Readers experience a number of adventures and come to their own revelations, sensing with their heart and acting on their intuition. See Earth from an interstellar traveler’s perspective and learn how to live within its harmony. TARRA: Mission to Earth, geared for ages nine to 12, has incredible magic hidden within. It opens every reader to a deeper understanding of our planet. “TARRA: Mission to Earth, The Family Companion” includes 34 tasks for children as well as an adult guide.

Purchase at https://amzn.to/3ympqOJ.

“Diamond Eyes Makes His Mark”

“Diamond Eyes Makes His Mark”

by DJ Key

Mark Van Buren, nicknamed Diamond Eyes, is a 14-year-old misfit who can't do anything right. When his father and stepmom plan to ship him to Florida to live with his uncle DJ and aunt Rita, founders of a cover band, the Ambient Images, he worries he won't be accepted. But when he fills in to sing one night, it changes his life.

Various adventures take him on an Alaskan cruise, the Las Vegas desert, an Amish farm, and a crocodile-infested swamp. The book is a testament to the trials and tribulations adolescents face in today's world, such as bullying, suicidal thoughts, loss of a loved one and sexual identity. Ultimately, it is a tale of faith, endurance and the power of unconditional love.

Purchase at https://amzn.to/3I12mcu.

NOTE: BookTrib’s Bites is presented by Booktrib.com.

(Reissued 9/16/2022)

-

-

- A decade ago, Infographics were the “it” tool to promote your business, but became a less desirable way of promoting your business a few years ago. NewsUSA, a brand content agency, argues that infographics are still one of the best marketing tools to pitch your clients.

- A decade ago, Infographics were the “it” tool to promote your business, but became a less desirable way of promoting your business a few years ago. NewsUSA, a brand content agency, argues that infographics are still one of the best marketing tools to pitch your clients.

- Inflation is top-of-mind for most Americans, as a majority say that they have reduced household spending in many areas except when it comes to retirement savings and life insurance.

- Inflation is top-of-mind for most Americans, as a majority say that they have reduced household spending in many areas except when it comes to retirement savings and life insurance. -

-  Jeffrey Breslow’s new memoir, “A GAME MAKER’S LIFE: A Hall of Fame Inventor and Executive Tells the Inside Story of the Toy Industry,” is the gripping account of how the inventor held his company together after an employee opened fire in the Marvin Glass and Associates conference room in 1976. The gunman killed two of the Chicago firm’s partners and an employee and critically wounded two more employees before killing himself. Jeffrey Breslow, a partner, missed taking a bullet only because the gunman didn’t see him -- he had just stepped into an adjoining office to take a phone call. The gunman left behind a hit list of fourteen names. Breslow later learned that his name was second on the list.

Jeffrey Breslow’s new memoir, “A GAME MAKER’S LIFE: A Hall of Fame Inventor and Executive Tells the Inside Story of the Toy Industry,” is the gripping account of how the inventor held his company together after an employee opened fire in the Marvin Glass and Associates conference room in 1976. The gunman killed two of the Chicago firm’s partners and an employee and critically wounded two more employees before killing himself. Jeffrey Breslow, a partner, missed taking a bullet only because the gunman didn’t see him -- he had just stepped into an adjoining office to take a phone call. The gunman left behind a hit list of fourteen names. Breslow later learned that his name was second on the list.  In spite of the tragedy, Breslow still felt incredibly lucky. Marvin Glass had personally hired him in 1967, soon dubbed him a “boy genius” and made him a partner after 18 months on the job.

In spite of the tragedy, Breslow still felt incredibly lucky. Marvin Glass had personally hired him in 1967, soon dubbed him a “boy genius” and made him a partner after 18 months on the job.

- Summer may be winding down, but it’s not over. Even as vacations end and school begins, summer weather and outdoor entertaining and activities linger into October in many places. Chilean lemons are the perfect complement to end-of-summer meals and drinks on the patio or in the park.

- Summer may be winding down, but it’s not over. Even as vacations end and school begins, summer weather and outdoor entertaining and activities linger into October in many places. Chilean lemons are the perfect complement to end-of-summer meals and drinks on the patio or in the park.  -

-  “Tuscan Son”

“Tuscan Son”  “Pressure Point”

“Pressure Point”  “A Sky of Infinite Blue”

“A Sky of Infinite Blue” “The Golden Gladiator”

“The Golden Gladiator”

- You may be among the

- You may be among the  -

-  “Ice Islands”

“Ice Islands”  “Think Healthy, Be Healthy”

“Think Healthy, Be Healthy”  “The Most Likely Club”

“The Most Likely Club”  “A Bend of Light”

“A Bend of Light”

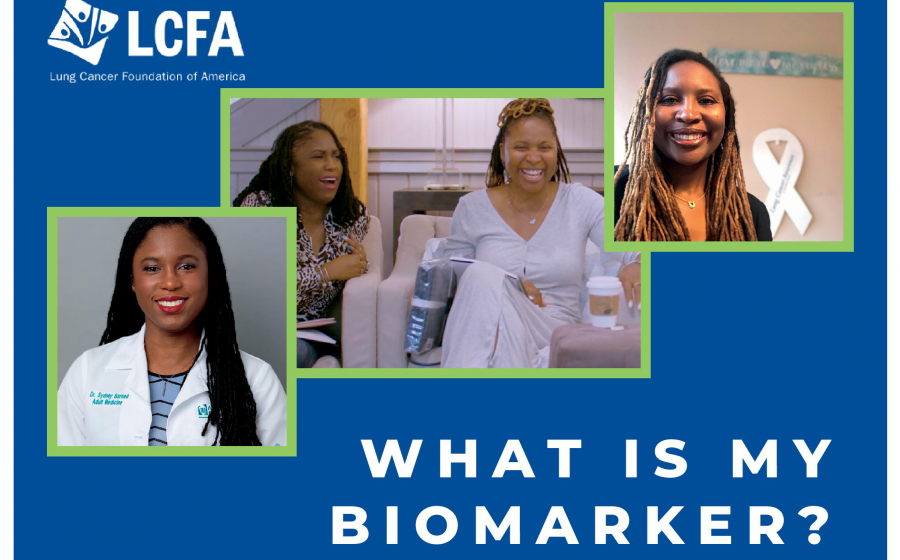

- Despite advances in diagnosis and treatment, lung cancer remains a leading cause of death for Black men and women. In the United States, estimates suggest that more than 73,000 Black individuals will die from lung cancer in the next year alone.

- Despite advances in diagnosis and treatment, lung cancer remains a leading cause of death for Black men and women. In the United States, estimates suggest that more than 73,000 Black individuals will die from lung cancer in the next year alone.

- Pulse Check: 3 Things You May Not Know About the Most Common Heart Rhythm Disorder

- Pulse Check: 3 Things You May Not Know About the Most Common Heart Rhythm Disorder