Tax Prep Tips You Need Now from Financial Pros

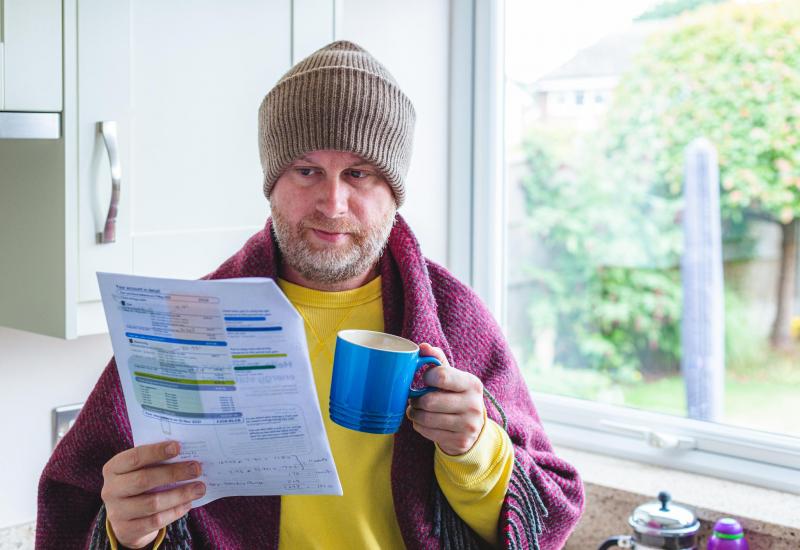

(NewsUSA) --Tax time is just around the corner, and although many people still face various degrees of financial upheaval in the wake of the ongoing Coronavirus pandemic, the IRS now says that taxes are due a bit later this year -- on May 17, 2021. If you haven't started organizing your tax materials, the time is now.

--Tax time is just around the corner, and although many people still face various degrees of financial upheaval in the wake of the ongoing Coronavirus pandemic, the IRS now says that taxes are due a bit later this year -- on May 17, 2021. If you haven't started organizing your tax materials, the time is now.

"CFP® professionals are uniquely qualified to guide you through these uncertain times," according to the website of CFP Board, a nonprofit organization dedicated to supporting professional standards in personal financial planning.

A CFP® professional can provide financial advice and support as you organize and prepare your finances for tax filing.

Here are pro tips for tax planning as April approaches:

- Stash some cash. Look at your cash flow, and make sure you have enough on hand that you can use to pay your taxes. If necessary, move some cash from one account to the account from which you will be paying your tax bill. Otherwise, you risk creating a tax debt that could extend for months.

- Review retirement accounts. Check with a CERTIFIED FINANICAL PLANNER™ professional if you aren't sure of the funding limits of any individual retirement accounts (IRAs) or Roth IRAs. Maximize contributions to these accounts each year to reduce your tax burden in the short term and optimize your retirement funds in the long term.

- Consider quarterly payments. Making quarterly payments on your estimated income tax can take some of the sting out of a big tax payment in April. Quarterly payments can be especially helpful for freelancers or contract workers whose incomes may be inconsistent. Ask your financial professional whether quarterly payments would be beneficial for you.

- Check your IRS Form 1099. Mistakes can be made, so be sure to review the details on the schedules attached to your 1099 forms. Check whether interest on municipal bonds is tax-free. Make sure qualified dividends and other preferentially taxed income is correctly reported, and make sure basis information is correct for capital gains. If you see errors on your 1099, report them as soon as possible.

Additionally, you can review updates to tax laws on the IRS website and on the appropriate website for your own state income tax boards.

Visit letsmakeaplan.org for more financial planning advice and tips for a smooth tax season.